Optional product pricing is a pricing strategy where the customer can pay a higher price for a product with additional features or benefits or a lower price for a basic version. This pricing can be used to increase sales of premium products or encourage customers to upgrade to a higher-priced product.

Optional product pricing can be implemented in several ways. For example, a company could offer two versions of a product, with the more expensive version including additional features or benefits. Or, a company could offer discounts on upgrades to customers who purchase the basic version of a product.

Benefits of Optional Product Pricing

- Optional pricing can help increase your product sales by allowing customers to purchase additional items at a discounted price.

- Optional pricing can also help you boost profits by allowing you to sell more expensive items to customers willing to pay a higher price.

- Optional pricing can encourage customers to buy multiple items from you, which can help increase your overall sales.

- Optional pricing can help you clear out inventory of older or less popular products by offering them at a discount.

- Optional pricing is also used as a marketing tool to entice new customers or encourage existing customers to come back and shop with you again.

- Optional pricing can give you more flexibility in pricing your products, which can be helpful if you’re trying to compete with other businesses in your industry.

- Optional pricing can let you experiment with different prices for different products and see which ones are most successful before committing to a permanent price change.

- Optional pricing gives customers the perception that they’re getting a deal when they purchase additional items, which can create goodwill and loyalty towards your business.

What is The Significance of Optional Product Pricing in The Business?

As businesses increasingly adopt a value-based pricing strategy, optional product pricing becomes more significant. Optional product pricing is a way to price products or services so that customers can choose what they want to pay within a specific range. This type of pricing can be used to encourage customers to purchase additional products or services, or to upsell them to a higher-priced option.

There are several benefits of using optional product pricing:

- It allows businesses to capture more value from their customers by enabling them to choose how much they want to pay.

- It can increase customer satisfaction by giving them more control over their purchase decision.

- It can help businesses boost sales and revenues by enticing customers to purchase optional add-ons or upgrades.

While optional product pricing can be beneficial for businesses, some risks are also involved. First, it can create confusion among customers and lower satisfaction levels if not appropriately handled. Second, companies must be careful not to set the price too low or too high, as this could either discourage purchases or result in lost revenue. Overall, optional product pricing is a potent tool to help businesses increase sales and capture more value from their customers. Still, it must be used carefully to avoid negative consequences.

Also Read: What Are The Stages And Examples Of A Product Lifecycle?

Pros & Cons of Optional Product Pricing

Optional pricing is a type of pricing where the customer can pay a higher price for a product or service that includes additional features or benefits. Optional pricing can be used in various ways but is most commonly seen as an upsell tactic in businesses such as restaurants, hotels, and online retailers.

Just like any other pricing system, there are both pros and cons to using optional pricing. Some of the advantages include the following:

- Increased revenues: By offering customers the option to pay more for added value, businesses can see a significant increase in revenue.

- Greater customer satisfaction: Customers who feel they are getting a good deal on an upgraded product or service are often more satisfied with their purchase.

- Improved perceived value: When done correctly, optional pricing can help improve the perceived value of a product or service in the eyes of the customer. This can lead to repeat business and positive word-of-mouth marketing.

On the flip side, there are also some possible disadvantages to consider, such as:

- Lower conversion rates: Offering too many options can lead to lower conversion rates as customers become overwhelmed and unsure of which option to choose.

- Reduced margins: Higher prices for added-value products and services mean reduced margins unless volumes increase significantly. This is especially true if competition begins offering similar optional upgrades at lower prices.

- Resentment from customers who don’t want to pay extra: While most customers understand that they may need to pay a little more, plenty dislike this culture.

Optional Product Pricing vs Captive Product Pricing

One of the most challenging decisions facing product managers is how to price optional products. There are two common approaches: captive product pricing and optional product pricing.

Captive product pricing is when the price of the optional product is included in the base product price. For example, if you buy a car, the dealer may offer you an extended warranty for an additional cost. The upper edge of this approach is that it simplifies the purchasing decision for customers. They don’t have to weigh the benefits and costs of the optional product since it’s already been factored into the price of the base product.

Optional product pricing is when customers pay an additional fee to add an optional product to their purchase. For example, many online retailers offer shipping insurance for an additional fee. The particular advantage that this approach is popular is that customers customize their purchases to their needs and budget.

Both approaches have their own sets of pros and cons, so ultimately, it depends on the product manager to decide which one makes more sense for their business.

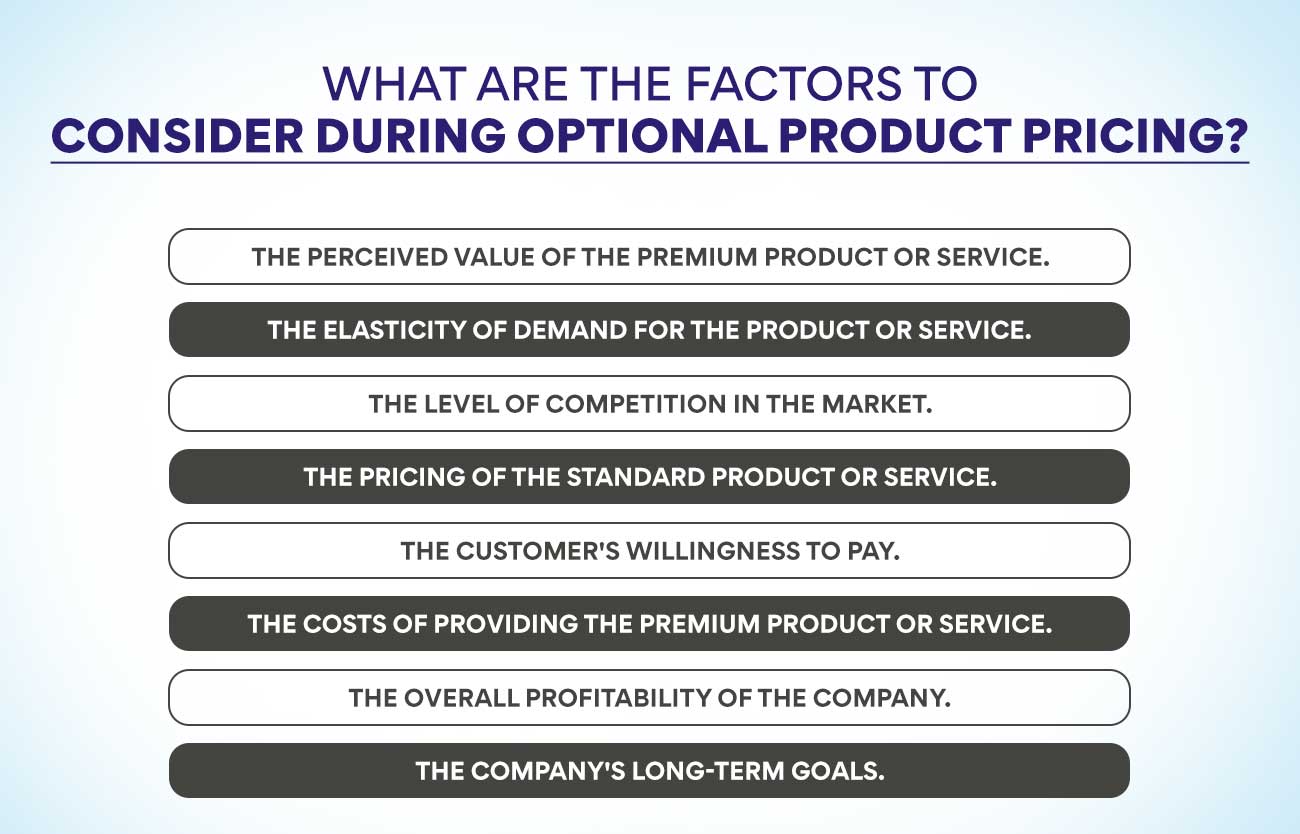

What Are The Factors To Consider During Optional Product Pricing?

Optional product pricing is deemed a popular pricing strategy whereby the customer can pay an additional price for a premium product or service. This type of pricing can be used in different situations, such as when selling add-ons or upgrades or when offering a luxury version of a product.

There are various factors that a product manager should consider when implementing optional product pricing:

- The perceived value of the premium product or service.

Customers need to perceive that the premium product or service is worth the additional price. If they don’t, then they’re unlikely to pay the extra amount. Ensure you communicate the benefits of the upgraded product or service and how it differs from the standard offering.

- The elasticity of demand for the product or service.

Elasticity refers to how much demand for a product or service changes in response to changes in price. If demand is highly elastic (i.e. people are susceptible to price changes), then optional pricing is less likely to work, as customers will simply choose the cheaper option. Conversely, if demand is inelastic (i.e. people are not very sensitive to price changes), then optional pricing can be successful as customers may be willing to pay more for a premium offering.

- The level of competition in the market.

If many competitors are offering similar products or services, then customers will be more price-sensitive, and optional pricing may not work as well; however, if you have a special product or service or few competitors. Customers may be less price sensitive and more likely to pay the additional price for a premium offering.

- The pricing of the standard product or service.

If the standard product or service is already expensive, then customers may be less likely to pay even more for a premium version. Conversely, if the standard product or service is relatively cheap, customers may be willing to pay a little extra for an upgraded version.

- The customer’s willingness to pay.

Some customers may be willing to pay any price for a premium product or service, while others will only pay a small premium. Understanding your target market and what they’re willing to pay is essential before implementing optional product pricing.

- The costs of providing the premium product or service.

If the costs of providing the premium product or service are high, you may need to charge a higher price to make a profit. Conversely, if the costs are low, then you can charge a lower price and still make a profit.

- The overall profitability of the company.

If the company is not profitable, then optional product pricing is unlikely to be successful. However, if the company is doing well financially, then optional pricing can be used as a way to increase profits.

- The company’s long-term goals.

Optional product pricing can be used as a short-term strategy to boost profits or as a long-term strategy to differentiate the company from its competitors. Consider the company’s goals when deciding whether optional product pricing is right for your business.

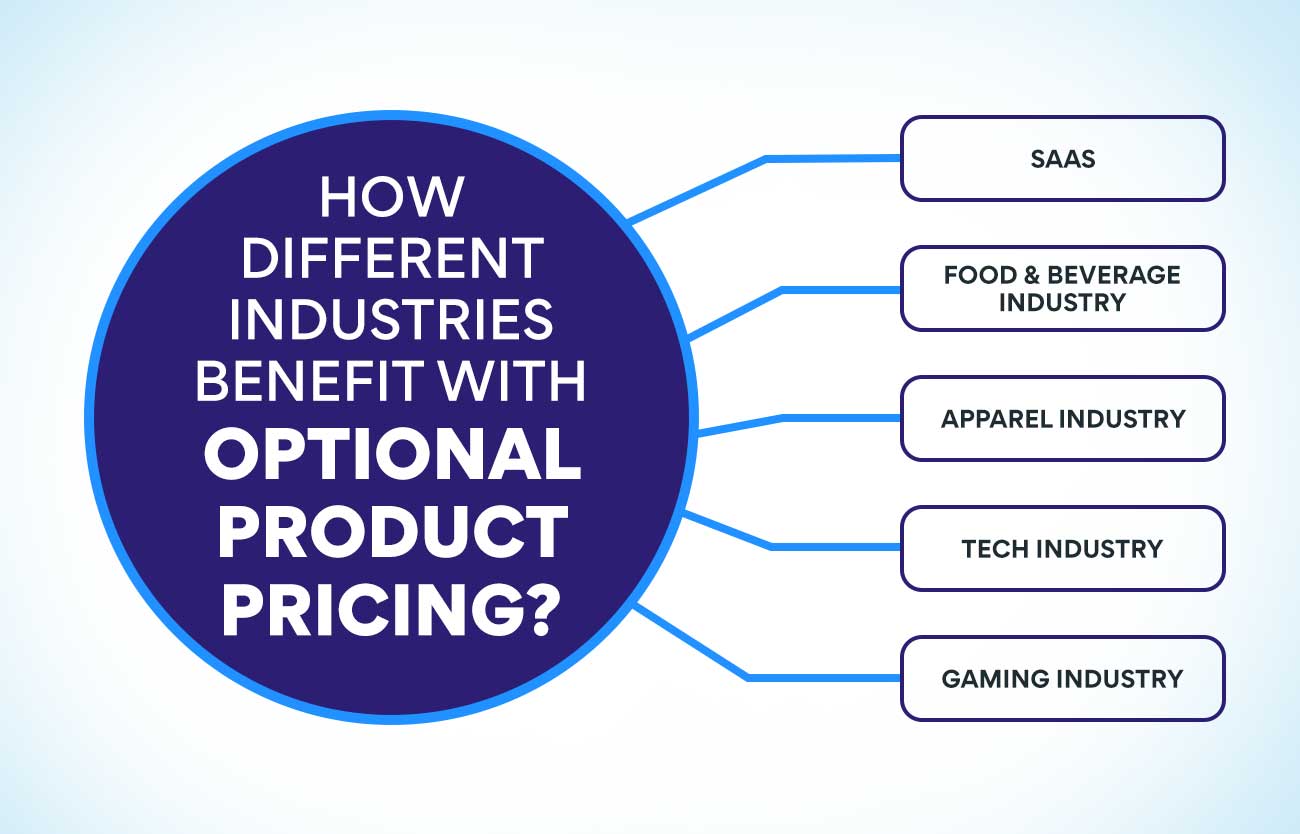

How do Different Industries Benefit From OPP?

SaaS

SaaS products have a lot of pricing options available to them. This is because the SaaS industry is still relatively new, and there are many different ways companies price their products. Some of the most common pricing models for SaaS products include subscription-based pricing, usage-based pricing, and feature-based pricing.

Subscription-based pricing is probably the most common type of pricing for SaaS products. This type of pricing involves charging a monthly or yearly fee for access to the product. This pricing type is beneficial because it is predictable and easy to understand. The downside is that it can be challenging to ascend up or down based on the customer’s needs.

Usage-based pricing is another popular option for SaaS products.

With this pricing, customers are charged based on how much they use the product. It can be an excellent option for customers who only need to use the product occasionally or want to pay based on actual usage. The downside of usage-based billing is that it can be hard to track usage and bill customers accurately if you don’t have a sound system.

Food & Beverage Industry

There are several different ways that food and beverage companies can price their products. The most common method is simply charging a fixed price for each item. However, some companies offer discounts for bulk purchases or customers who purchase multiple items. Additionally, many foods and beverage companies offer loyalty programs that reward customers for continued patronage.

Another popular pricing strategy in the food and beverage industry is called “dynamic pricing.” It involves constantly changing prices based on real-time demand. For example, a company might raise prices during lunch rush hour or on weekends when more people are likely to be out and about. By contrast, prices would be lowered during slower periods, such as late at night or early in the morning.

Finally, some food and beverage companies offer subscription-based models, where customers pay a monthly or yearly fee in exchange for access to exclusive content or deals. For example, a coffee shop might offer a subscription that includes unlimited brewed coffee and discounts on speciality drinks. Or a meal delivery service might offer subscribers free shipping on all orders over $50.

Apparel Industry

The apparel industry is very competitive; as such, many companies are striving to stand out from the crowd. One way to do this is by offering optional pricing for their products. This means that customers can pay a higher price for a product that includes features or benefits they value more highly. For example, a customer might be willing to pay extra for a shirt made from organic cotton or ethically sourced.

This type of pricing can be beneficial for both customers and companies. Customers can choose what they feel is worth paying more for, and companies can use optional pricing to differentiate their products in the marketplace and make more profit. However, optional pricing only works if customers perceive value in the additional features or benefits being offered. Otherwise, they will simply choose the cheaper option every time.

Tech Industry

There is no one-size-fits-all answer, as the pricing of optional products in the tech industry will vary depending on different factors, including the type of product, its features and benefits, the company’s target market, and the competitive landscape. However, there are a few general tips that companies should keep in mind when pricing optional products:

- Don’t underprice your product. If you do, customers may perceive it as low quality or not worth the investment.

- Do your research to ensure that your pricing aligns with what similar products are selling for in the market.

- Be flexible with your pricing options – consider offering discounts for customers who purchase multiple products or tiered pricing options based on how many features a customer wants access to.

- Make sure your prices reflect the value customers will get from using your product. You should charge accordingly if your product offers significant advantages over competitor products.

Also Read: A Guide To Formulate An Excellent Product Strategy

Gaming Industry

There are several different ways that companies in the gaming industry can choose to price their products. Some companies opt for a simple pricing structure, where all products are priced at a fixed rate. Others may use a more complex pricing strategy, where different products are priced differently based on various factors.

One common way to price optional products is based on the product’s perceived value. For example, if a company believes its new game will be extremely popular and generate a lot of excitement among gamers, it may price the game higher than other games on the market. On the other hand, if a company believes its new game may not be popular as its competitors’ games, it may price the game lower to entice customers to purchase it.

Another way to price optional products is based on the cost of production. Companies often have different costs associated with developing and manufacturing different types of games. For instance, games that require more development time or expensive hardware components to run may be priced higher than simpler games. Companies may also factor in shipping and handling costs when determining how to price their products.

Conclusion

Optional product pricing is a great way to mount up the average order value and boost your profits. By offering customers the option to pay more for upgraded or premium versions of your products, you can make more money while still providing them with value. When using optional product pricing, it’s essential to ensure that the price difference is justified and that the upgrades are worth it. Otherwise, you risk losing customers and damaging your reputation. Used correctly, though, optional product pricing can be a potent tool for growing your business.

Our course Advanced Executive Certificate in Product Management will teach you everything you need about optional product pricing. You’ll learn how to set prices that maximize profits while still providing value to your customers. With this knowledge, you’ll be able to ace your game as a product manager and create products that people love.

More Information:

Steps To Create A Successful Go-To-Market Strategy

What Is Product Planning And How Is It Done?

7 Dynamic Stages of the New-Age Product Development Process

Brand Management v/s Product Management: Know Key Differences